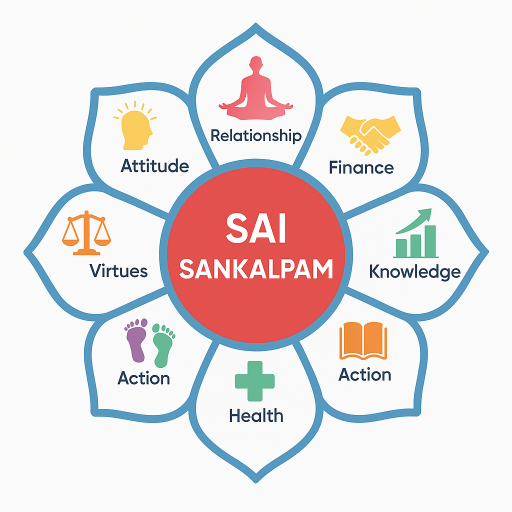

Ethical Financial Management as a Spiritual Practice: A Journey of Faith and Discipline

As the founder of SaiSankalpam.com, I have embodied the belief that financial management is not just a worldly endeavor but an intrinsically spiritual practice. This ethos has guided my journey, as both a financial consultant and a disciple of Sai Baba’s teachings, to align the energies of wealth with the Four Pillars of Dharma, Artha, Kama, and Moksha. Contrary to the view of wealth as a mere tool for material comfort, I see it as a conduit to fulfill life’s deeper purpose when used ethically and responsibly.

The Four Pillars: A Holistic Framework

The Four Pillars of Hindu philosophy—Dharma (duty), Artha (wealth), Kama (desires), and Moksha (liberation)—are not just esoteric concepts but practical guidelines for ethical living. In my career, especially during moments of immense financial success in trading, I learned that Artha supports Dharma. The wealth I generated was not just for personal gain but to carry out my duties—be it towards my family, community, or spiritual goals. Sai Baba said, “Money comes and goes, morality comes and grows.” This reminded me to view wealth as transient, emphasizing ethical stewardship.

The T.E.A.R. Formula: Guiding Financial Ethics

At SaiSankalpam.com, I devised what I call the T.E.A.R. Formula: Transparency, Ethics, Accountability, and Responsibility. This formula is my compass in both personal finance and business, ensuring every financial decision is aligned with these core values. Transparency in financial dealings builds trust, Ethics ensure that our means of earning do not compromise our values, Accountability keeps us conscious of the impact our financial decisions have, and Responsibility reminds us of our duty to use wealth for the greater good.

Ethical Earning:

During my early years in trading, there was a temptation to maximize profits through any means necessary. However, I quickly learned that ethical earning was non-negotiable. I recall a particularly volatile market phase when insider tips could have drastically increased my earnings. The decision point was challenging, yet the T.E.A.R. Formula kept me grounded. By choosing transparency and ethics over short-term gains, I built a reputation that has proven more valuable than any windfall.

Mindful Spending:

Spending can quickly spiral into impulsive decisions, disregarding the original purpose of wealth. Adopting the practice of mindful spending has been a transformative experience for me. I allocate a part of my monthly income to charity, recognizing that wealth’s primary utility is to serve and uplift others. Establishing a “charity budget” ensures that giving remains intentional and not just a spur-of-the-moment choice.

Service-Based Prosperity:

The most fulfilling aspect of ethical financial management has been channeling wealth towards service-based prosperity—using resources to empower others. I remember a project where I invested in educational opportunities for underprivileged children. It was not just a financial investment but a step towards building their future. This act of service was deeply rewarding, aligning my financial decisions with a higher purpose.

Personal Stories of Discipline and Faith

Throughout my career and trading life, discipline and faith have been the anchor. Time-blocking is a habit that instills discipline, allowing me to dedicate focused periods to trading, reflection, and spiritual practice. Time management not only improves efficiency but also ensures that my actions are consistent with my goals.

Gratitude is another cornerstone of my financial philosophy. Keeping a “gratitude ledger” where I note financial and personal blessings has shifted my perspective from scarcity to abundance. This practice of gratitude reminds me of Sai Baba’s principle of detachment—appreciating the resources we have without becoming attached.

Actionable Habits for Ethical Financial Management

Here are three actionable habits that embody the concepts I’ve discussed:

-

Time-Blocking: Allocate specific times for financial activities, spiritual practice, and reflection. This instills discipline and helps maintain a balanced approach to wealth and life.

-

Charity Budget: Designate a portion of your income for charitable activities. This ensures that you actively partake in service-based prosperity, using wealth for the greater good.

-

Gratitude Ledger: Maintain a journal to record daily what you’re thankful for, both financially and personally. This habit fosters a mindset of abundance and detachment.

In conclusion, ethical financial management is not merely an aspect of life but a spiritual practice that nurtures the soul. By integrating discipline, faith, and ethical considerations, we can navigate the material world while fulfilling our spiritual goals.

May your journey be blessed with prosperity and purpose.

Dr. Ravindranath G is the founder of SaiSankalpam.com, an advocate for ethical financial practices inspired by spiritual principles. For more insights and practical tips on financial and spiritual growth, visit SaiSankalpam.com.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 42,048 readers