Keyword: Financial Wellness

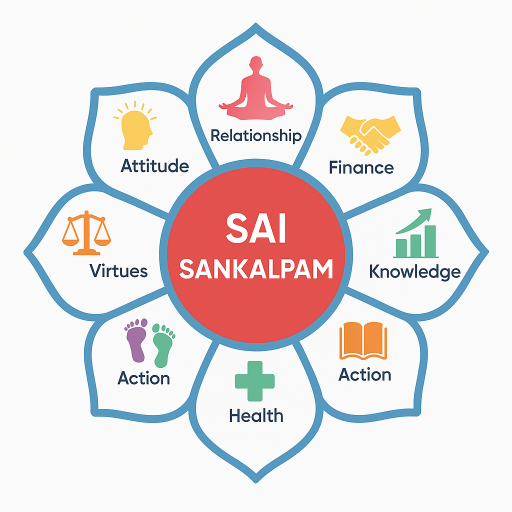

In the fast-paced world we inhabit, financial wellness often eludes many of us. The cornerstone of achieving and maintaining financial wellness lies in adopting practices that are ethical, mindful, and geared towards both personal prosperity and communal service. SaiSankalpam’s core principles offer a guiding light on this journey, emphasizing ethical financial practices, mindful spending, saving, and investing for long-term prosperity. Let’s explore how these principles can transform not just your wallet, but your whole life.

Ethical Financial Practices: The Foundation of Trust

Ethical financial practices form the bedrock of financial wellness. It’s about making financial decisions that not only benefit you but also consider the wider impact on your community and environment. Imagine you decide to invest in a local business that employs sustainable practices. Not only are you earning a return, you’re also supporting ethical entrepreneurship and fostering economic growth in your area.

Embrace transparency in all your financial dealings. Whether you’re buying, selling, or investing, ensure that your actions align with your values. This might mean opting for companies with fair trade certifications or investing in green technologies. The peace of mind that comes from knowing your money contributes to positive change is invaluable.

Mindful Spending: Aligning Values with Actions

Mindful spending is about being intentional with your money. It involves distinguishing between wants and needs, and ensuring that your spending habits align with your personal values and financial goals. Before making a purchase, ask yourself: “Does this align with my values? Is it necessary, or am I acting out of impulse?”

Picture a person browsing the latest smartphone models. Instead of succumbing to the allure of the newest release, they consider whether their current device meets their needs. By resisting a needless upgrade, they practice mindful spending—redirecting those funds towards meaningful experiences or savings.

Saving and Investing: Building for the Future

Saving and investing are the pillars of long-term financial prosperity. Saving is about setting aside a portion of your income for future needs, emergencies, or opportunities. Consider starting a savings plan tailored to your lifestyle—whether it’s 10% of your monthly income or gradually increasing your savings rate as your earnings grow.

Investing, on the other hand, allows your money to work for you. Imagine a person who regularly saves $200 monthly in a diversified investment fund. Over time, compounding interest increases their wealth significantly more than if they had saved the money in a traditional bank account. Research and choose investment vehicles that align with your risk tolerance and financial goals, such as stocks, bonds, or mutual funds.

Spiritual Insights: Wealth as a Tool for Growth and Service

From a spiritual perspective, wealth is not merely a measure of personal success but a tool for greater good. It allows us to not only satisfy personal desires but also contribute to the well-being of others. This philosophy echoes in many spiritual teachings, advocating for a balance between material wealth and spiritual fulfillment.

Consider someone who has achieved financial stability and decides to use a portion of their wealth to support education for underprivileged children. By doing so, they transform their financial prosperity into a vehicle for communal growth and service.

Three Actionable Steps for Financial Wellness

-

Conduct a Financial Audit: Set aside time to review your financial habits. List your income, expenses, savings, and investments. Identify areas where ethical and mindful changes can be introduced. This evaluation will act as a roadmap for your financial journey.

-

Set Realistic Goals: Establish clear, achievable financial goals that reflect not just personal ambitions but also how you can service others. Whether it’s starting a saving plan for college funds or donating to a cause, having clear goals helps maintain focus.

-

Educate Yourself Continuously: The financial world is constantly evolving. Keep abreast of new financial practices, investment opportunities, and ethical companies. Knowledge empowers you to make informed decisions that benefit both you and the community.

In conclusion, financial wellness isn’t just about accumulating wealth but rather about thriving ethically and deliberately. By integrating the principles of ethical practices, mindful spending, and strategic saving and investing, we can harness wealth as a tool for personal growth and the betterment of society. Let us strive to make financial wellness not merely a personal success story but a chapter in the larger narrative of communal prosperity and service.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 28,490 readers