Ethical Financial Management as a Spiritual Practice: A Journey of Wealth and Wisdom

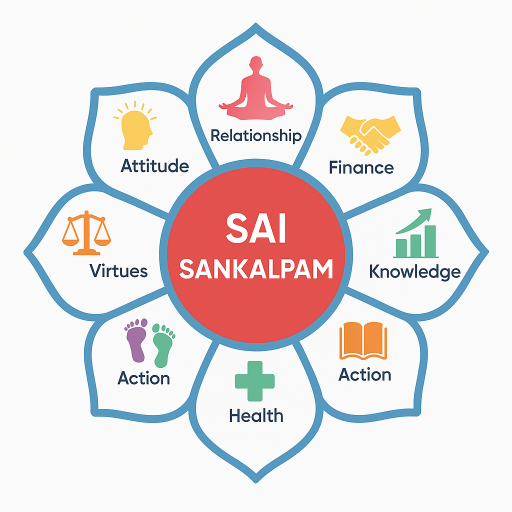

I am Dr. Ravindranath G, founder of SaiSankalpam.com, and today I’d like to share my experiences on how ethical financial management can be a profound spiritual practice. This journey not only nurtures personal growth but also aligns with the teachings I’ve cherished from Sai Baba, especially in terms of the right use of wealth.

Wealth and the Four Pillars of Life

In my understanding, the Four Pillars of Life—Dharma (righteousness), Artha (wealth), Kama (desires), and Moksha (liberation)—are interconnected. Wealth (Artha) is crucial, but its management must remain in harmony with righteousness (Dharma). This balance ensures that our desires (Kama) do not overshadow our path to liberation (Moksha).

Ethical financial management is about integrating these pillars seamlessly. It requires discipline, wisdom, and faith, values I have learned over my 20-year career in finance and trading.

Introducing the T.E.A.R. Formula

To manage wealth ethically, I developed the T.E.A.R. Formula, which stands for Thoughtful Earning, Attentive Spending, Enlightened Investing, and Responsible Giving. Here’s how each component guides us:

-

Thoughtful Earning: Reflect on the sources of your income. Are they aligned with your values? During my early trading days, I was tempted by shortcuts promising quick profits. However, a mentor from my spiritual camp reminded me, “Ravindranath, earn in ways that bring peace, not just prosperity.”

-

Attentive Spending: Mindful spending enhances gratitude for what we have. I maintain a “Spending Gratitude Ledger,” noting purchases and reflecting on their true value. This habit, akin to practicing mindfulness, has kept my desires in check and instilled a sense of contentment.

-

Enlightened Investing: Investing should not solely be about returns; it is a tool for positive change. I remember investing in ethical startups promoting sustainable energy. Not every investment grew monetarily, but the learning enriches me spiritually.

-

Responsible Giving: A portion of our wealth should support others. I’ve set up a “Charity Budget” as a monthly routine. Sai Baba said, “You must be ready to sacrifice if you wish to receive.” This teaching resonates deeply as I witness how responsible giving transforms both the giver and the receiver.

Personal Stories of Discipline and Faith

Discipline and faith have shaped my career and personal growth substantially. As a young analyst, I encountered a market crash that wiped out significant investments. I was disheartened, pondering over losses for days. But one morning, I recalled Sai Baba’s saying, “Let the dead past bury its dead.” This encouraged me to detach from the loss and focus forward.

Another instance involves my practice of time-blocking, which I learned from trial and error. By dedicating specific hours to analysis, learning, family, and spiritual activities, I experienced a more balanced life. The discipline enabled me to handle market fluctuations with equanimity, following the principle that wealth should not rob us of our peace.

5 Actionable Habits for Ethical Financial Management

-

Time-Blocking for Financial Health: Allocate dedicated time each week to review your financial goals, investments, and budgets. Regular reflection keeps you aligned and aware.

-

Charity Budget: Set aside a fixed percentage of your income for charitable activities each month. This habit embeds generosity in your financial routine, creating a fulfilling and spiritually enriching practice.

-

Spending Gratitude Ledger: Maintain a ledger to record your purchases and reflect upon their necessity and value. This habit nurtures mindful consumption and greater satisfaction.

-

Weekly Review Sessions: Conduct brief weekly sessions to evaluate if your earnings and expenditures align with your core values and long-term goals. This periodic check reinstates ethical practices.

-

Meditative Financial Planning: Before making significant financial decisions, engage in meditation or quiet reflection to ensure decisions resonate with your spiritual and ethical beliefs.

Conclusion: Wealth as a Bridge to Spirituality

The integration of ethical financial management as a spiritual practice enables us to view wealth as a means to enrich our spiritual journey. It elevates financial activities from mere transactions to transformative experiences. By embracing the T.E.A.R. Formula and embedding actionable habits into our lives, wealth becomes more than material: it acts as a bridge to a life of purpose, peace, and ultimate freedom.

Thank you for accompanying me on this reflective journey. If you find these insights beneficial, join our community at SaiSankalpam.com where we explore the synergy of spirituality, ethics, and financial wisdom.

May your financial path align with your spiritual journey,

Dr. Ravindranath G

Founder, SaiSankalpam.com

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.