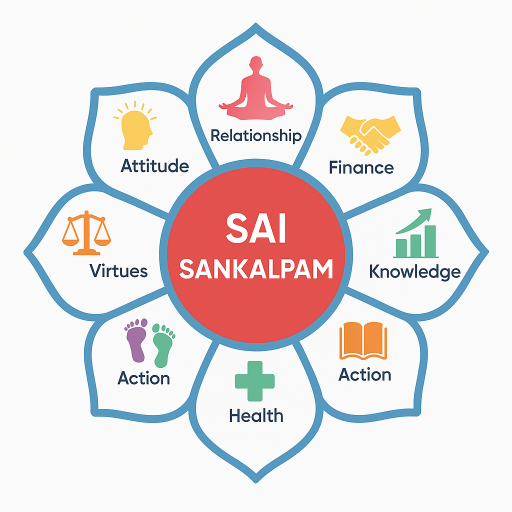

Ethical Financial Management as a Spiritual Practice: A Journey of Wealth and Wisdom

I am Dr. Ravindranath G, founder of SaiSankalpam.com, a platform dedicated to aligning spiritual principles with practical life, especially in the realms of finance and personal development. In my years of experiencing the highs and lows of trading and finance, I’ve come to profoundly believe that managing wealth ethically is not just a financial endeavor but a spiritual practice. It is a journey that requires discipline, mindfulness, and a deep sense of purpose. As we navigate this path, we encounter the Four Pillars: Dharma (righteousness), Artha (wealth), Kama (desire), and Moksha (liberation). Wealth, when viewed through these pillars, becomes a means to live a balanced and fulfilling life.

The Four Pillars and Wealth

The pursuit of wealth, often seen in isolation, can be a perilous path. However, when integrated with Dharma, it becomes a tool for righteous living. Artha, the pursuit of wealth, is not merely about accumulation but about creating resources that support one’s duties (Dharma), fulfill rightful desires (Kama), and ultimately guide us toward liberation (Moksha).

One day, while deep into my trading career, a significant loss shook me. It was a moment of reflection, a test of my attachment to financial success. I recalled a quote from Sai Baba: “Money is a means to an end, not the end itself.” This teaching reminded me that the right use of money lies in supporting one’s duty towards self and others and not merely in amassing it. Such experiences have been pivotal in shaping my understanding of ethical wealth management, reminding me that wealth is a servant, not a master.

The T.E.A.R. Formula

Over the years, I have developed a guiding principle called the T.E.A.R. Formula, designed to bring integrity and mindfulness into financial transactions:

- T (Transparency): Conduct all financial dealings transparently, ensuring open communication and honesty.

- E (Ethical Earning): Earn through means that do not compromise your values or harm others.

- A (Accountable Spending): Spend mindfully, in accordance with your needs and the needs of those you’re responsible for.

- R (Return and Service): Give back to society and foster generosity, ensuring your wealth serves a greater good.

This formula acts as a moral compass, ensuring that the acquisition and use of wealth are harmonized with one’s spiritual path.

Personal Stories of Discipline and Faith

Over my career, I’ve learned that discipline and faith are the cornerstones of financial and spiritual resilience. I recall a time when an investment I was sure of began sinking. Panic gripped me initially, but faith in my principles anchored me. Instead of reacting impulsively, I adhered to disciplined time-blocking for analysis and reflection, ensuring every decision aligned with my broader goals.

On another occasion, a fortunate windfall blessed me with unexpected wealth. Remembering my mother’s teachings to always allocate a portion of wealth to charity, I created a charity budget within my financial plan. This act of giving not only brings immeasurable joy but also instills a sense of purpose, allowing me to see wealth as a conduit for fostering the well-being of others.

Actionable Habits for Ethical Financial Management

The journey to integrate ethical financial management into one’s life can be nurtured through daily habits:

-

Time-Blocking: Dedicate specific time blocks for financial analysis and planning. This structured approach prevents impulsive decisions and ensures thoughtful engagement with your financial health.

-

Charity Budget: Set aside a fixed percentage of your income or profits for charitable causes. This habit cultivates a generous spirit and ensures that your wealth contributes positively to society.

-

Gratitude Ledger: Maintain a daily ledger where you record financial blessings and opportunities you encounter. Reflecting on this fosters a mindset of abundance and gratitude, crucial for spiritual growth.

-

Mindful Spending Assessments: Regularly assess your spending to ensure it aligns with your values and long-term goals, prioritizing needs over wants.

-

Financial Learning: Commit to ongoing financial education, deepening your understanding of ethical investing and wealth management practices.

Conclusion

Integrating spirituality with financial management transforms money from a simple tool for personal gain into a dynamic force for good. By viewing wealth through the prisms of the Four Pillars and applying the T.E.A.R. Formula, we cultivate an approach that respects both material and spiritual laws. This thoughtful blend of ethics and spirituality in finance leads to a life of balance, fulfillment, and legacy.

As we continually align our financial practices with our spiritual values, let us remember Sai Baba’s wisdom on detachment: “The root of all unhappiness is attachment to the worldly.” May we use money wisely, embracing it as a servant to our greater goals, ever mindful of the harmonious journey to which it belongs.

For more insights on integrating spirituality with everyday life, visit us at SaiSankalpam.com. May your path be abundant and illuminated by peace and purpose.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 36,518 readers