“Dear reader, today I invite you to reflect with me on a powerful truth about wealth…”

When I was a young resident in medical school, I encountered a patient who unknowingly imparted a lesson I hold dear to this day. He was a modest farmer who battled relentless chronic pain. Despite his limited means, he managed to bring joy to those around him and carry an air of contentment that seemed to defy his circumstance. Through our conversations, I learned that he viewed wealth not in terms of money, but as the richness of spirit, health, and gratitude.

His story was a profound reminder that wealth is not merely financial – it is energy, responsibility, and a reflection of one’s inner state. With this understanding, we can approach financial management as an ethical and spiritual practice.

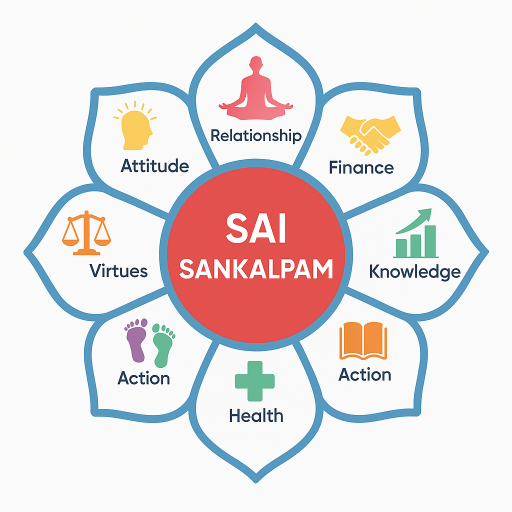

The Five Pillars of Life call us to examine different aspects of living. Ethical financial management strengthens these pillars in remarkable ways:

Health: By reducing stress with mindful choices and stability, financial peace becomes a form of wellness.

Relationships: Trust and shared responsibility can foster harmony in our connections with others.

Financial Wisdom: Emphasizing ethical earning and mindful spending shapes decisions that align with our values.

Knowledge: Each financial experience is a lesson that enhances our skills and awareness.

Inner Peace: Practicing detachment and embracing contentment allows clarity and gratitude to be ever-present.

Let us apply the T.E.A.R. Formula in our exploration of wealth. Ethical thoughts cultivate clean financial energy; this energy, in turn, shapes disciplined actions; disciplined actions bring about stable, prosperous results, and when prosperity is shared, it becomes sacred.

Consider these actionable wealth habits to infuse your financial life with purpose and mindfulness:

- Time-block for financial review: Dedicate time each week to reflect on your financial health.

- Maintain a gratitude ledger: Acknowledge your earnings and blessings.

- Pause before purchases: Cultivate mindful spending by differentiating needs from wants.

- Set a service-based budget: Regularly allocate resources for giving back.

- Track emotional triggers: Discover deeper motivations behind your financial decisions.

In my own trading journey, I’ve often encountered situations that tested my patience and detachment. There was a time when an unexpected market shift led to significant losses. It was a humbling yet enlightening experience that reaffirmed my belief in detachment—with faith and discipline, I learned to release the emotional grip money had on me.

Sai Baba wisely said, “Money comes and goes; morality comes and grows.” This quote reminds us to prioritize moral growth and ethical actions over transient wealth.

Please share your thoughts, reflections, or questions in the comment box below. I value every comment and read each one with love and gratitude.

For more insights and resources on aligning wealth with spirituality, visit SaiSankalpam.com.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.