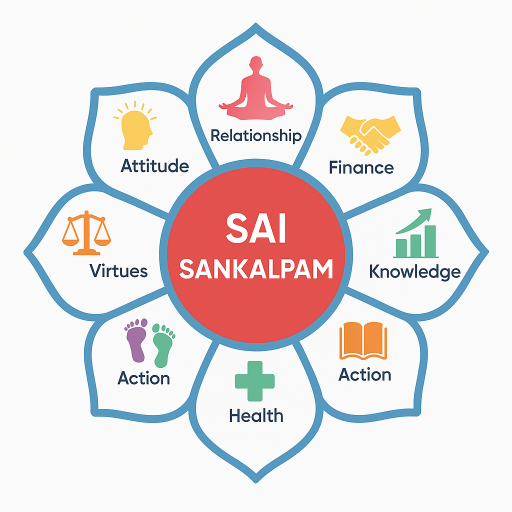

Title: Embracing Wealth with Purpose: The SaiSankalpam Approach to Financial Prosperity

Navigating the vast realm of finance can be daunting, yet with the right principles, it transforms from confusion to clarity. At the heart of ethical financial practices lie SaiSankalpam’s core tenets: mindful spending, diligent saving, and strategic investing centered on long-term prosperity. This holistic approach emphasizes not just wealth accumulation, but its purpose — using resources to uplift oneself and serve others.

Ethical Financial Practices

At its core, ethical financial practices involve aligning monetary habits with moral and spiritual values. It means ensuring that decisions are made with integrity and respect for all involved. By practicing honesty in transactions and avoiding exploitative or harmful ventures, individuals generate wealth that not only supports personal growth but also contributes positively to society.

Consider the story of Ravi, a budding entrepreneur. By consciously choosing to source materials sustainably and treating his team fairly, he not only cultivated a successful enterprise but also fostered community development. Ravi’s journey exemplifies how ethical business practices can lead to prosperity that benefits the greater good.

Mindful Spending

Mindful spending is about making purchasing decisions intentionally, considering both necessity and value. It encourages individuals to distinguish between needs and wants, promoting a lifestyle that prioritizes well-being over excess.

For instance, before making purchases, think like Maya, a teacher who transformed her financial life by asking, “Does this align with my values?” This simple question helped her avoid unnecessary expenses, enabling her to allocate resources towards experiences and causes that truly enriched her life.

Saving and Investing for Long-Term Prosperity

The practice of saving underscores patience and discipline, allowing individuals to prepare for future opportunities and challenges. Investing, on the other hand, involves growing these savings through calculated and informed decisions. Both practices are fundamental in achieving long-term financial health.

Take the example of Arjun, a software engineer, who began saving a modest portion of his salary each month. By researching and choosing ethical investment avenues, he not only grew his finances but also supported companies that aligned with his beliefs. Arjun’s diligence ensured that his wealth was not only multiplying but doing so in a way that resonated with his values.

Spiritual Insights: Wealth as a Tool for Growth and Service

From a spiritual perspective, wealth is more than a collection of numbers — it is energy that, when used wisely, can facilitate growth and service. The teachings of SaiSankalpam emphasize humility and gratitude, encouraging individuals to view resources as a means to uplift oneself and others.

Consider the impact of Raj and Anjali, a couple committed to community service. By allocating a portion of their income to educational initiatives, they have created scholarships that foster the potential of countless students. Their story highlights how wealth, when channeled towards service, can create ripples of positive change that benefit society as a whole.

Practical Tips and Actionable Steps

-

Align Spending with Values: Before making purchases, pause and reflect whether they truly enhance your life and align with your core values. Prioritize meaningful experiences over material accumulation.

-

Commit to Regular Saving: Automate savings to ensure consistency. Even small amounts, regularly saved, compound over time, providing a sense of security and opportunity for future growth.

-

Educate Yourself on Ethical Investments: Research and choose investments that align with your moral compass. Consider funds or stocks that support sustainable and socially responsible initiatives.

In conclusion, SaiSankalpam’s principles provide a comprehensive roadmap to financial prosperity that extends beyond personal gain. By integrating ethical practices, mindfulness, and spiritual insights into our financial journey, we not only foster personal well-being but also contribute to the flourishing of our communities. Wealth, after all, is not an end in itself but a powerful tool for reaching our highest potential and uplifting those around us. Through careful choices and purposeful living, we can transform financial success into a legacy of positive impact.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 9,485 readers