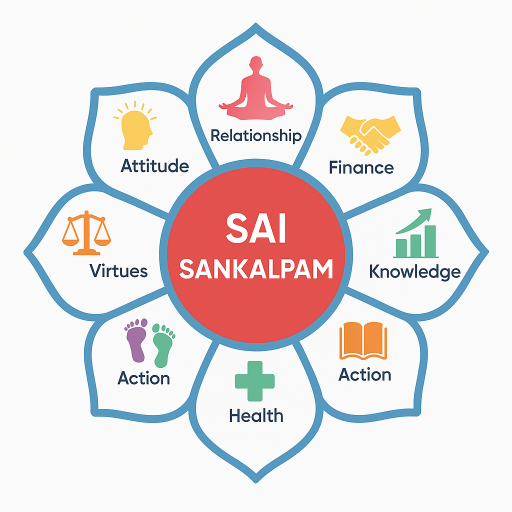

Embracing Ethical Financial Practices: SaiSankalpam’s Path to Prosperity

In today’s fast-paced world, managing finances can feel overwhelming. Yet, the principles of SaiSankalpam offer a beacon of hope, guiding us through ethical financial practices, mindful spending, and investing for long-term prosperity. At the heart of these principles lies the understanding that wealth, when managed wisely, becomes a powerful tool for personal growth and service to others. Let’s delve into how these principles can transform our financial journey.

Ethical Financial Practices: The Moral Compass

Ethics in financial practices are crucial. They offer a moral compass that ensures our wealth not only benefits us but also serves the greater good. By adopting ethical practices, we align our financial decisions with our values, fostering trust and respect in all interactions. This alignment is especially critical in today’s interconnected economy where every transaction can have a ripple effect.

Consider the simple yet profound act of investing in companies that prioritize social responsibility. By doing so, we support businesses that contribute positively to society, from sustainable practices to community enrichment. Similarly, transparent financial dealings build lasting relationships, be it personal or professional. This approach not only strengthens our financial foundation but also brings us peace of mind knowing our wealth contributes to the collective good.

Mindful Spending: Harnessing Intentionality

Mindful spending is the art of making informed purchasing choices that reflect our values and priorities. It encourages us to question our impulses, understand our needs, and appreciate our resources. This practice is not about deprivation but about intentionality.

Imagine choosing to purchase fewer, but higher-quality items, rather than indulging in frequent, low-cost acquisitions. The benefits are twofold: we reduce waste, and we cultivate gratitude and contentment for what we own. This mindful approach extends beyond material goods to experiences, emphasizing quality time spent with loved ones over costly, superficial engagements.

Saving and Investing: Building Long-term Prosperity

Effective saving and investing are pillars of financial prosperity. They safeguard our future while allowing our wealth to grow steadily over time. SaiSankalpam encourages us to view saving and investing as acts of self-care, providing security and opportunities for growth.

Start by establishing an emergency fund, a safety net that shields against life’s uncertainties. Next, embrace the power of compounding by investing early and consistently. Whether through retirement accounts, stocks, or mutual funds, diversified investments pave the way for sustainable growth. Importantly, these investments should echo our values, enhancing our commitment to ethical practices.

Spiritual Insights: Wealth as a Tool for Growth and Service

Wealth, when perceived through a spiritual lens, transforms into a means of personal and communal growth. It empowers us to uplift ourselves and others, becoming a catalyst for service. The principles of SaiSankalpam remind us that true prosperity lies in sharing, in extending our resources for the welfare of those around us.

Consider philanthropy as an integral part of your financial strategy. It can be as modest as supporting local businesses or as ambitious as funding educational programs for the underprivileged. Each act of giving fosters a cycle of goodwill, transforming money into a spiritual asset that nurtures collective prosperity.

Three Actionable Steps to Align Financial Behavior with SaiSankalpam Principles

-

Evaluate and Adjust Financial Practices: Regularly assess your financial habits and ensure they align with your ethical and spiritual values. Prioritize transparency and integrity in all transactions.

-

Adopt Mindful Spending Habits: Before making a purchase, pause to consider its necessity and impact. Opt for quality over quantity and seek businesses that mirror your values.

-

Strategize Saving and Investing: Start small, but start now. Establish clear saving goals and explore investment options that resonate with ethical standards, ensuring long-term growth.

By embracing SaiSankalpam’s principles, we can navigate the financial landscape with confidence and purpose. Through ethical practices, mindful spending, saving, and investing, we can use our wealth not only for personal gain but as a force for good, paving the way for a life of prosperity and fulfillment.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.