“Dear reader, today I invite you to reflect with me on a powerful truth about wealth…”

Many years ago, as a young medical student, I attended to a patient who had lost nearly everything in a financial downfall. This individual taught me one of the most profound lessons of my life: the real wealth we hold isn’t the figures in our bank accounts, but the strength we find in adversity. Watching how gracefully this patient navigated their challenges, I realized that true wealth extends beyond money; it is energy, responsibility, and a reflection of one’s inner state.

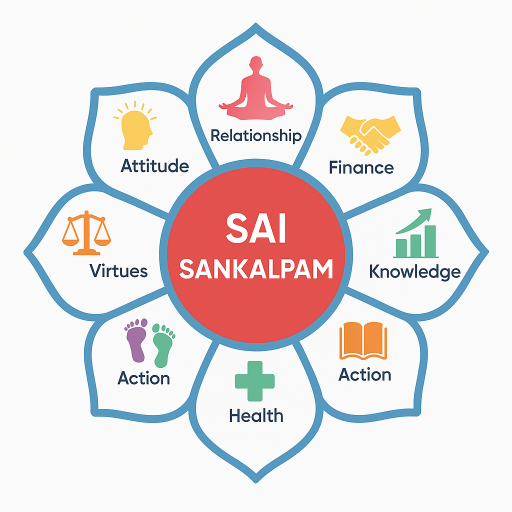

Ethical financial management is akin to nurturing a garden — it involves care, discipline, and patience. Just as in medicine or trading, where precision and timing are crucial, handling wealth requires understanding its deeper influence on the Five Pillars of Life:

Health: With mindful financial choices, stress reduces, allowing us stability and peace of mind.

Relationships: Trust and shared responsibility foster harmony, ensuring that financial matters enhance rather than strain our connections.

Financial Wisdom: Ethical earning and mindful spending help align financial decisions with our inner values.

Knowledge: We grow by learning through experience, sharpening our skills, and heightening our awareness.

Inner Peace: Through detachment and contentment, we thrive in clarity and gratitude, recognizing that wealth is not an end but a means.

In essence, wealth abides by the T.E.A.R. Formula — Thought → Energy → Action → Result. Ethical thoughts foster clean financial energy, which shapes disciplined actions. These actions render stable and prosperous results, and when prosperity is shared, it becomes a sacred act of service.

Ethical earning, mindful spending, and service-based prosperity are spiritual practices when aligned with our core values. Here are some actionable wealth habits that I have found invaluable:

-

Time-blocking for financial review: Set aside regular intervals to reflect on your financial state, aligning it with your goals and values.

-

A monthly charity/service-based budget: Dedicate a portion of your earnings to charity, recognizing that giving back enriches the soul.

-

Maintaining a gratitude ledger: Note daily earnings and expenses with gratitude, fostering appreciation for both abundance and sufficiency.

-

Mindful spending: Pause before making purchases, ensuring they serve a true need rather than a fleeting want.

-

Tracking emotional triggers: Understand the emotions that guide your financial decisions, fostering awareness and control.

I recall a trading experience early in my career where detachment taught me an essential lesson. After investing significant effort, the stocks plummeted. Instead of succumbing to despair, I practiced patience and detachment. This allowed me to learn from the situation, ultimately leading to future successes. It’s within the essence of stepping back, viewing wealth not as an idol to cling to, but as a resource to manage responsibly.

In the words of Sai Baba, “Money comes and goes; morality comes and grows.”

Please share your thoughts, reflections, or questions in the comment box below. I value every comment and read each one with love and gratitude.

For more insights and resources on aligning wealth with values, visit SaiSankalpam.com.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.