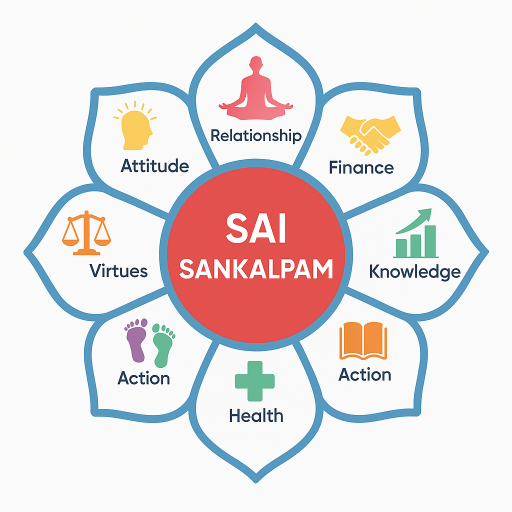

Harnessing Wealth for Personal Growth and Service: The Guiding Principles of SaiSankalpam

In today’s fast-paced world, financial stability often seems elusive, overshadowed by fluctuating markets and societal pressures. However, amidst this uncertainty lies an opportunity to cultivate financial wisdom that not only secures our personal well-being but also serves the greater good. SaiSankalpam offers a holistic approach to managing wealth through its core principles: ethical financial practices, mindful spending, saving, and investing for long-term prosperity. These principles align not only with practical financial wisdom but also with profound spiritual insights, showcasing how wealth can be a vital tool for growth and service to others.

Ethical Financial Practices: Building Trust and Integrity

At the heart of SaiSankalpam’s philosophy is the need for ethical financial practices. This principle underscores the importance of honesty and transparency in our financial dealings, fostering trust and integrity. For instance, consider a local business owner who prioritizes fair wages and ethical sourcing. By embedding ethical considerations into their business model, they cultivate a loyal customer base and a positive reputation, ultimately leading to sustainable success. This integrity creates a ripple effect, encouraging others to act with similar ethical mindfulness.

Mindful Spending: Conscious Consumption for a Better Tomorrow

Mindful spending, another cornerstone of SaiSankalpam, reminds us that every purchase is an opportunity to align our values with our financial habits. It’s about making informed choices that reflect our priorities and fostering gratitude for what we have. Imagine walking into a grocery store with a list comprising only essentials and opting for quality over quantity. This practice not only helps in saving money but also reduces waste and encourages a more intentional lifestyle. Mindful spending encourages us to reflect on the necessity of our purchases and prioritize experiences over material possessions.

Saving: The Foundation of Financial Resilience

Saving is the bedrock upon which financial security is built. SaiSankalpam encourages setting aside a portion of our income regularly, no matter how small, as a buffer against future uncertainties. Picture a young professional diligently committing to a monthly savings plan. Over time, this habit grows into a robust emergency fund, providing peace of mind and the freedom to pursue opportunities without financial anxiety. Consistent saving cultivates a sense of discipline and foresight, essential components for long-term prosperity.

Investing for Long-term Prosperity: Planting Seeds of Growth

Investing wisely is akin to planting seeds for future growth. SaiSankalpam teaches that investments should be made with careful research and a focus on long-term benefits rather than short-term gains. Consider an individual who invests in education or skills development, thereby enhancing their ability to generate income in the future. Similarly, those who invest in diverse portfolios are not merely securing their financial future but are also supporting economic growth and innovation.

Wealth as a Tool for Growth and Service

Beyond personal gain, SaiSankalpam envisions wealth as a powerful tool for personal development and community service. When we view our resources as means to uplift others, we transform our financial achievements into a legacy of generosity. Imagine donating a portion of your income to meaningful causes or volunteering your time and skills to support those in need. Such acts of giving not only enrich the lives of others but also provide a deep sense of fulfillment and connection.

Actionable Steps to Implement SaiSankalpam’s Principles

-

Create a Financial Integrity Plan: Start by evaluating your financial practices. Are they aligned with your values? Make necessary adjustments to ensure transparency and honesty in all transactions.

-

Adopt a Mindful Spending Challenge: For one month, track all expenses and categorize them based on necessity and value. Use this information to cultivate a habit of conscious spending, ensuring that your financial choices reflect your priorities.

-

Set Up an Automatic Savings and Investment Plan: Establish a system where a fixed percentage of your income automatically goes into savings and investment accounts. This disciplined approach will steadily build your financial resilience and prepare you for future opportunities.

By embracing SaiSankalpam’s principles, you can transform your relationship with money, fostering a path of ethical prosperity that benefits not just you, but the world around you.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 52,307 readers