“Dear reader, today I invite you to reflect with me on a powerful truth about wealth…”

In the corridors of hospitals where I once paced as a young doctor, I learned invaluable lessons beyond the reach of textbook knowledge. There was a particular night, etched in my memory, when a critical surgery demanded every ounce of patience and calm I had. In the middle of this life-or-death procedure, I realized the essence of detachment—not from care or responsibility, but from the outcomes beyond my control. This very detachment, cultivated in operating rooms, translates seamlessly into our relationship with wealth. Money, like life in those hospital halls, is not just currency—it’s an energy, a duty tempered with inner peace.

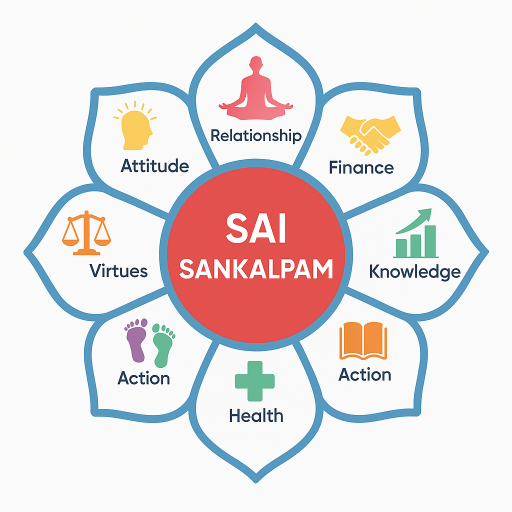

Ethical financial management, I believe, strengthens the Five Pillars of Life which I have come to cherish deeply:

Health is nurtured through reduced stress and stability achieved via mindful financial decisions. When we approach money thoughtfully, our bodies and minds remain in harmony, free from anxiety’s clutches.

Relationships flourish when there is trust and shared responsibility concerning finances, thus fostering a household where harmony reigns.

Financial Wisdom emerges when we earn ethically, spend mindfully, and ensure our decisions reflect our deeper values.

Knowledge thrives as we learn from our monetary experiences, continuously refining our skills and expanding awareness.

Lastly, Inner Peace is realized in detachment, contentment, and gratitude—a state where money serves rather than masters.

The T.E.A.R. Formula epitomizes this journey: Thought leads to Energy, Energy to Action, and Actions shape our Results. When our financial intentions are grounded in ethics, the resultant energy arises pure, guiding us to disciplined acts that yield stability and prosperity. When prosperity is shared through service, it transcends into a holy practice.

Let’s delve into wealth as a spiritual exercise further by integrating ethical earning and mindful spending into our daily routines. Here are a few habits to cultivate:

-

Time-block for Financial Review: Dedicate specific time weekly or monthly to review finances, fostering awareness and enabling informed decisions.

-

Maintain a Gratitude Ledger: Record each earning and expense with gratitude, recognizing both as parts of your abundant flow.

-

Pause Before Buying: Allow a moment of reflection before purchases to discern true needs from ephemeral wants.

-

Track Emotional Triggers: Identify and contemplate emotions influencing financial choices, cultivating detachment and clarity.

-

Charity or Service-Based Budget: Allocate a portion of your finances for monthly charitable activities, integrating giving into your financial planning.

Reflecting on my journey as a trader, patience and responsibility were virtues that became crucial in navigating market fluctuations, much as they are essential in managing personal wealth. Trading taught me that wealth is transient, not unlike the ephemeral victories and losses on the trading floor. This awareness instilled a lasting belief—wealth in its truest form is a tool for growth, service, and deeper self-understanding.

To conclude, I am reminded of a profound quote from Sai Baba: “Money comes and goes; morality comes and grows.” Such words inspire us to see wealth as serving the greater call of Dharma—righteous living.

Please share your thoughts, reflections, or questions in the comment box below. I value every comment and read each one with love and gratitude.

For more insights on aligning your financial journey with spiritual growth, visit SaiSankalpam.com.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.