Title: Wealth and Wisdom: Embracing Ethical Financial Management as a Spiritual Practice

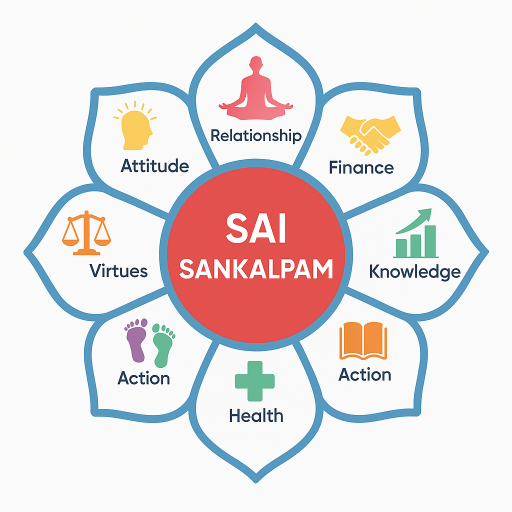

In my journey as the founder of SaiSankalpam.com, I have come to view financial management not merely as a set of strategies for wealth accumulation, but as a profound spiritual practice. The integration of ethical financial management with spiritual principles can serve as a compass that guides us toward a more fulfilled life. This understanding stems from many years of experience and reflection, both in my career and personal life, as I pursued wealth not just for its material comfort, but as a means to foster growth, responsibility, and service to others.

The Four Pillars of Wealth Management—Earn, Save, Spend, and Share—are intrinsically aligned with spiritual values. When I began my career, I didn’t foresee the challenges and lessons that would cement my understanding of these concepts. Early on, I encountered significant shifts in the stock market that tested not only my financial acumen but my resolve and ethical grounding. The highs of successful trades were eclipsed by the sobering losses that sometimes followed. It was during these moments that the words of Sai Baba resonated deeply: “Money comes and goes, but morality comes and grows.”

This realization prompted a shift in my perspective, urging me to view wealth through the lens of the Four Pillars. Earning ethically involves recognizing the source of our income and ensuring that it aligns with moral values. To aid this process, I developed the T.E.A.R. Formula—Thrive, Earn, Align, Reinvest—a holistic approach to financial and ethical prosperity. This formula serves as a guide for ethical earning, mindful spending, and service-based wealth distribution.

1. Thrive: In whatever you do, ensure it contributes to the greater good. The notion of thriving transcends personal success; it encompasses the wellbeing of your community and environment. An ethical career choice is not just about paycheck size; it’s about aligning your profession with your values—something I learned when I transitioned from pure financial gain to establishing SaiSankalpam.com, which combines prosperity with service.

2. Earn: Earning with integrity means capitalizing on skills and opportunities without compromising ethics. Throughout my career, I focused on transparency and fairness—principles I never allowed to be overshadowed by mere profit. In the trading arena, where temptations for shortcuts abound, maintaining ethical consistency required discipline, a virtue bolstered by spiritual fortitude.

3. Align: Expenditure should reflect our values. Mindful spending involves consciously choosing where and how we allocate our resources. During my transition to ethical financial management, I began to view every expense as a statement of my priorities, aligning them with long-term spiritual and personal goals.

4. Reinvest: Finally, sharing wealth through reinvestment in society is paramount. Whether through supporting community projects or providing financial guidance, I discovered that sharing wealth can cultivate a ripple effect of prosperity. Reinvestment is not just financial but also involves dedicating time and skills to uplift others.

Among the habits that have reinforced my commitment to ethical financial management is time-blocking, a strategy that ensures I dedicate focused periods to financial planning and spiritual reflection without the distraction of daily hustle. Alongside it, maintaining a charity budget allows me to honor the wealth I receive by systematically giving back—a practice that fosters detachment from greed and fulfills my duty to society.

Gratitude has been another cornerstone of my journey. Keeping a gratitude ledger where I regularly acknowledge both financial opportunities and spiritual lessons has deepened my appreciation for life’s abundant resources. In recognizing wealth as a tool rather than an end, each entry reminds me to act with humility and responsibility.

Always remember, as Sai Baba said, “Detachment does not mean non-involvement. You can be deeply involved but not entangled.” The wealth we pursue and manage should be approached in this spirit—deeply involved yet detached from unnecessary possessiveness.

To those embarking on this path, understand that wealth is multifaceted; its true value lies in its potential to create positive change. By integrating spiritual practices within financial management, we can redefine prosperity—not just for ourselves but for the broader community.

As I continue to guide others through SaiSankalpam.com, my commitment remains to foster an understanding of wealth as an ethical and spiritual journey. Through the Four Pillars and the T.E.A.R. formula, we can all endeavor to earn, grow, and share in a manner that honors both our spiritual and worldly responsibilities.

For those interested in exploring more about this harmonious blend of wealth and wisdom, I invite you to join our community at SaiSankalpam.com. Together, we can walk the path of ethical prosperity, guided by wisdom both ancient and new.

Dr. Ravindranath G

Founder, SaiSankalpam.com

https://www.saisankalpam.com

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 12,987 readers