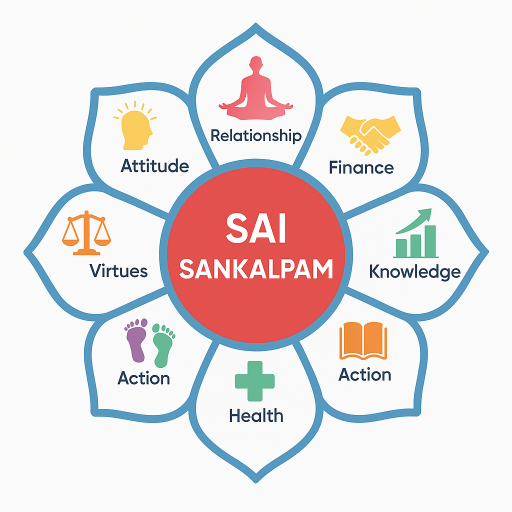

Title: Navigating the Financial Path with Spiritual Integrity

As the founder of SaiSankalpam.com, my journey has been a harmonious blend of spirituality and financial practice. By intertwining these dimensions, I’ve come to view ethical financial management as not just a discipline, but a profound spiritual practice. Through the lens of experience, I believe that wealth serves as a critical component of life’s Four Pillars: Dharma (duties), Artha (wealth), Kama (desires), and Moksha (liberation). It is through these pillars that I understand the true essence of prosperity, guided by the T.E.A.R. Formula that emphasizes Thoughtful Earning, Ethical Spending, Amplified Savings, and Responsible Service.

Wealth and the Four Pillars

The Four Pillars offer a comprehensive framework for living a balanced life. Artha, the pursuit of wealth, does not stand alone. It supports and is supported by Dharma, Kama, and Moksha. Right earning and spending, aligned with Dharma, ensure that our financial pursuits are righteous and support our greater life purposes. Artha also satisfies Kama, our legitimate desires, in a way that leads to Moksha, spiritual liberation.

One of the cornerstone teachings from Sai Baba that continues to guide me is: “Wealth is not to be sold to fill one’s pockets; it is to be shared with others.” This profound notion of detachment underscores the importance of viewing wealth not as a goal but as a means to fulfill life’s responsibilities and to contribute to the well-being of others.

The T.E.A.R. Formula

-

Thoughtful Earning: My career began with humble roots, where thoughtful earning was critical. I learned that integrity in earning builds a sustainable foundation for both personal satisfaction and societal contribution. By aligning my skills with the needs of others, I found purpose.

-

Ethical Spending: Every Rupee spent is an ethical decision. During my trading career, this principle became particularly vivid. The adrenaline rush of gains can be intoxicating, but it is the discipline of ethical spending that ensures those gains lead to sustainable prosperity rather than transient satisfaction.

-

Amplified Savings: I learned early on the power of compound growth — not just of investments but also of good deeds. Amplified savings represent both financial growth and the accumulation of virtues, leading to peace of mind and resilience.

-

Responsible Service: Ultimately, wealth’s highest purpose is service. I recall a period of life when trading was prosperous, yet without contributing to the community, the prosperity felt hollow. It was only through service that real fulfillment emerged.

Personal Experiences

Throughout my career, there were moments that tested my adherence to these principles. I recall a time during a volatile market period when an opportunity for massive gain arose. The easy path tempted me, yet the lessons of disciplined and faithful practice urged restraint. Choosing ethical paths over short-term gains brought not only peace but unexpected, sustainable success. This discipline is akin to spiritual practice, requiring faith that the ethical way will ultimately yield the greatest good.

Actionable Habits for Ethical Financial Management

-

Time-Blocking for Financial Health: Dedicate specific time blocks to manage finances with mindful attention. Just as meditation requires focus, so does understanding and aligning with one’s financial state.

-

Charity Budget: Create a specific portion of the budget dedicated to charity. This habit keeps wealth in circulation and aligns personal prosperity with community growth. Practicing this brings to life Baba’s teachings that true detachment comes from realizing wealth is meant to serve.

-

Keeping a Gratitude Ledger: Documenting daily financial gratitudes enhances contentment and highlights the abundance already present. This practice shifts focus from what is lacking to what is already available.

-

Setting Intentional Financial Goals: Just as spiritual goals are set to enhance personal growth, financial goals should serve life’s greater purposes beyond material acquisition. Align goals with values and the Four Pillars for balance.

-

Regular Financial Reflection: End each month with a financial reflection. Assess what was earned, spent, saved, and shared not as a ledger check, but as an introspection of ethical alignment and expectations.

In closing, cultivating a harmonious relationship between wealth and spiritual values doesn’t just enrich personal life; it lays the foundation for a prosperous community. As we journey together, may our paths be lit by the wisdom of spiritual principles and the clarity of ethical financial practice.

For more insights on integrating spirituality with everyday living, visit SaiSankalpam.comwhere we embrace the converging paths of prosperity, ethics, and spirituality.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 19,323 readers