“Dear reader, today I invite you to reflect with me on a powerful truth about wealth…”

I am reminded of a poignant moment early in my medical career that taught me a lesson on financial patience and discipline. As a young physician, the allure of immediate high returns was tempting, yet my mentor emphasized the importance of consistent, ethical practices over hasty decisions. This echoed a simple truth: wealth is not just an accumulation of money, but the energy that manifests through disciplined actions, reflecting one’s inner state.

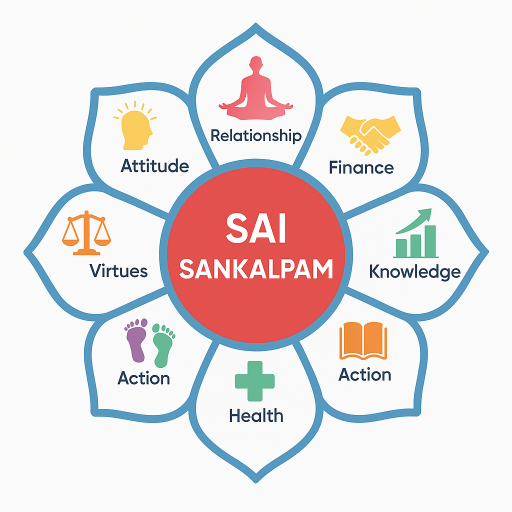

Wealth, in its truest sense, encompasses responsibility and the state of our inner being. By undertaking ethical financial management, we contribute to the Five Pillars of Life that support our journey:

Health – Through reduced stress and mindful choices, financial stability enhances our well-being.

Relationships – Shared financial responsibility cultivates trust and harmony with those around us.

Financial Wisdom – We learn from ethical earning and mindful spending, ensuring our decisions are aligned with our core values.

Knowledge – Each experience bears lessons, skills, and heightened awareness.

Inner Peace – A sense of detachment from material obsession fosters clarity, gratitude, and contentment.

This framework is underpinned by what I call the T.E.A.R. Formula: Thought → Energy → Action → Result. By cultivating ethical thoughts, we create a foundation of clean financial energy. This energy guides our discipline in actions, which then manifest into stable and prosperous outcomes. When prosperity is shared in service, it transcends into something sacred.

To turn this philosophy into practice, consider adopting these actionable wealth habits:

- Time-blocking for Financial Review: Set aside a specific time each week to assess your finances consciously.

- Monthly Charity or Service-Based Budget: Allocate a portion of your resources to those in need, nurturing a spirit of giving.

- Gratitude Ledger for Earnings and Expenses: Maintain a journal to foster appreciation for what you receive and spend.

- Mindful Spending: Pause before a purchase to analyze whether it aligns with your values.

- Separating Needs from Wants: Clarify necessities versus desires to avoid impulsive decisions.

In my trading experiences, the principle of detachment played a crucial role. I learned that becoming too emotionally entwined with market fluctuations only led to stress and impulsive decisions. Instead, practicing patience allowed me to observe, learn, and make choices rooted deeply in my values.

Sai Baba once said, “Money comes and goes; morality comes and grows.” This powerful insight reminds us to cultivate wealth as a tool for spiritual growth and service.

Please share your thoughts, reflections, or questions in the comment box below. I value every comment and read each one with love and gratitude.

For more insights, visit SaiSankalpam.com. Together, let us continue to explore and deepen our understanding of ethical wealth in our lives.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.