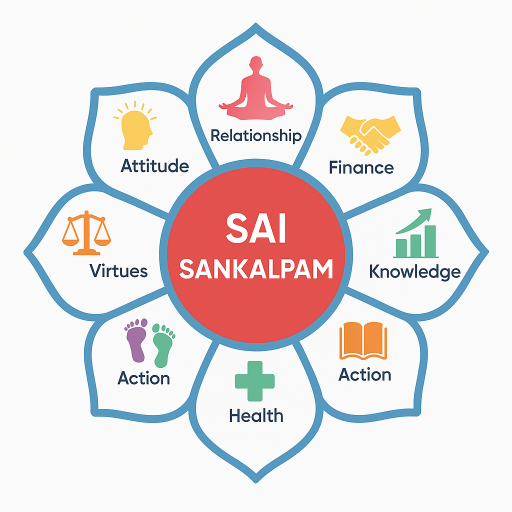

Ethical Financial Management as a Spiritual Practice: A Journey Through SaiSankalpam

As the founder of SaiSankalpam.com, I’ve always believed that ethical financial management can be more than just a pragmatic approach—it can serve as a deeply spiritual practice. My journey in the realms of finance, spirituality, and trading has taught me that wealth is not merely a means to an end. Instead, it is intricately connected to what I refer to as the Four Pillars: Dharma (righteousness), Artha (wealth), Kama (desire), and Moksha (liberation).

Understanding Wealth Through the Four Pillars

The Four Pillars offer a framework for achieving a balanced life. Wealth, represented as Artha, allows us to fulfill our roles and responsibilities, not only to ourselves but also to society. But achieving balance means that wealth should never overshadow Dharma or take us away from Moksha. Instead, each pillar should support and enhance the other.

Baba once said, “Money must be used to spread dharma.” This sentiment has been my guiding light in practicing ethical financial management.

The T.E.A.R. Formula

To integrate spirituality with financial pursuits, I developed what I call the T.E.A.R. Formula, which consists of:

-

Transparency

Be honest about your financial state. In my trading career, I learned that not being transparent with oneself, let alone others, creates a web of deceit. This started when I found myself investing in ventures purely for the thrill of gain, without truly understanding the implications. Recognizing this, I transitioned to transparency. I learned, for instance, the importance of keeping a ‘financial truth diary’ where I documented not just my earnings and spendings but also the motivations behind them. This practice shifted my mindset from gaining wealth to ensuring its responsible stewardship.

-

Ethical Earning

This involves acquiring wealth through means that align with one’s own Dharma. During my early career, the temptation of fast income through riskier trading swayed my judgment. A pivotal moment came when I suffered a loss that was devastating, not just financially but spiritually. Since then, I’ve committed to earning in ways that are beneficial not just to me but also to those around me, ensuring that every business decision is in harmony with my values.

-

Accountable Spending

Spending wisely is not just about budgeting; it’s about channeling finances in a way that adds value to life and society. I’ve adopted an approach I call ‘value-centric spending’. It’s about asking before each purchase, “Does this align with my higher purpose?” Time-blocking for financial assessments has become a staple in my routine, allowing me to consider these questions continually.

-

Redistribution and Charity

Sai Baba emphasized “Detach yourself from your possessions for peace.” This teaching underscores the importance of sharing wealth to alleviate others’ hardships. I’ve made it a point to designate a fixed percentage of my income to charitable causes, treating it as a non-negotiable ‘spiritual tax’. This habit has not only brought peace but also a visceral understanding of interconnectedness.

Personal Stories of Discipline and Faith

During my journey, I encountered moments where my discipline and faith were tested, particularly during economic downturns when my investments faltered. I recall vividly the 2008 financial crisis when even seasoned traders felt the floor pulling beneath them. It was discipline in sticking to my ethical framework and faith in the constructive power of wealth that saw me through. More than ever, I clung to Baba’s quotes on detachment, realizing that my worth was not tied to my bank balance but my character.

Actionable Habits

-

Time-Blocking: Schedule regular sessions dedicated to financial planning. Allocate time not just for accounting financial resources, but for spiritual reflection on these practices.

-

Charity Budget: Create a separate budget that is solely for charity. Make it a non-negotiable line item that reflects one’s commitment to redistribution.

-

Gratitude Ledger: Maintain a ledger listing daily entries of gratitude, especially for financial blessings. This not only helps in appreciating the abundance but also in viewing wealth as a means to an end.

-

Budget Introspection Sessions: Once a month, review your spending in light of the Four Pillars during a peaceful setting. Use this time to align your spending habits with your spiritual objectives.

-

Mindful Pause Before Purchases: Before making any significant financial decisions, pause and ask yourself, “Does this align with my spiritual and ethical values?”

Ethical financial management, when practiced as a spiritual exercise, transcends the ordinary pursuit of wealth. It becomes a pathway to achieving not only success but also spiritual fulfillment. At SaiSankalpam, I’ve seen how transforming one’s relationship with wealth can transform life itself, bringing serenity where there was once stress and purpose where there was once pursuit.

For those embarking on this journey, remember that the aim is not merely to accumulate wealth, but to cultivate a sense of prosperity that enriches your life and the lives of those around you.

Dr. Ravindranath G is the Founder of SaiSankalpam.com. Access resources to integrate spiritual and financial growth at SaiSankalpam.com.

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 35,166 readers