“As you arrive in this moment, I welcome you with sincerity and gratitude. Today, let us embark on a journey to understand how wealth serves not only our material needs but also our spiritual growth.

Reflecting on my early years in the medical field, I remember the immense patience and discipline required in patient care. Each moment taught me responsibility, not just in healing but in how I approached my financial decisions. It was during these times I first recognized that wealth is more than just money. It’s an energy that mirrors our internal state and can be cultivated for greater good.

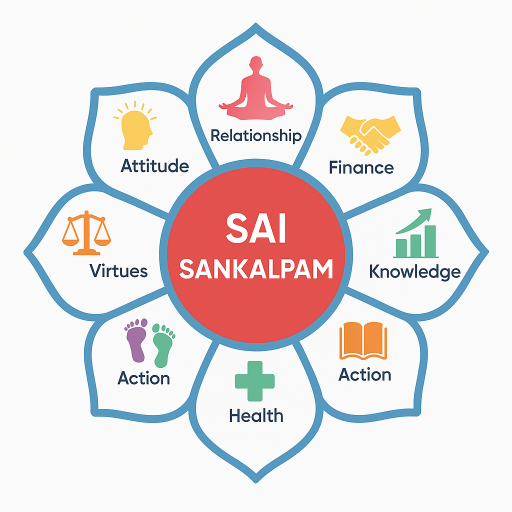

Wealth, when managed ethically, can strengthen what I refer to as the Five Pillars of Life. It reduces stress, bringing stability and mindful choices to our Health. It fosters harmonious Relationships built on trust and shared responsibility. Financial Wisdom emerges through ethical earning, mindful spending, and making aligned decisions. Our pursuit of Knowledge deepens as we learn through experiences, gaining skills and awareness. Finally, Inner Peace is achieved through detachment, contentment, clarity, and gratitude.

This philosophy is deeply intertwined with the T.E.A.R. Formula: Thought → Energy → Action → Result. Ethical thoughts generate clean financial energy, which in turn shapes disciplined actions. These actions lead to stable, prosperous results that, when shared in service, transform prosperity into a sacred notion.

Ethical earning is about aligning our actions with our core values, ensuring that our profession and income sources serve a greater good. Mindful spending involves scrutinizing our purchases—pausing to distinguish between needs and wants. Service-based prosperity encourages us to allocate a portion of our wealth towards uplifting others, thus practicing wealth as a spiritual act.

Here are some actionable habits to cultivate ethical financial management: 1. Time-block a weekly financial review to stay aligned with your monetary goals. 2. Set a monthly charity or service-based budget, channeling a portion of earnings towards societal upliftment. 3. Maintain a gratitude ledger, reflecting on earnings and mindful expenditures. 4. Practice mindful spending by pausing and assessing emotional triggers before purchases.

Throughout my years in trading, I learned valuable lessons in discipline and detachment. Watching market fluctuations taught me that quick reactions can lead to unwise decisions, reinforcing the importance of a balanced, grounded approach to finance—qualities that also enhance spiritual well-being.

As Sai Baba wisely said, ‘Money comes and goes; morality comes and grows.’ This timeless advice reminds us that true wealth lies not in the sum of riches but in the richness of our character and our contributions to the world.

Please share your thoughts, reflections, or questions in the comment box below. I value every comment and read each one with love and gratitude.”

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.