Ethical Financial Management: A Spiritual Practice

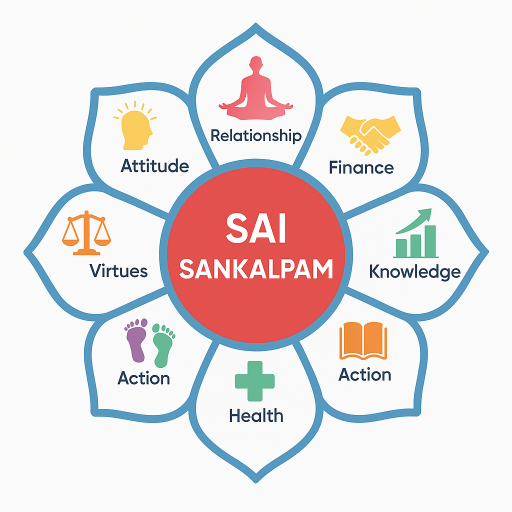

Greetings, dear readers. I am Dr. Ravindranath G, founder of SaiSankalpam.com. Today, I would like to share my insights on integrating ethical financial management as a spiritual practice into our daily lives. It is my belief that wealth management should not only be about accumulating assets but also about aligning our financial actions with higher spiritual principles.

The Four Pillars of Spiritual Financial Management

In my journey as an entrepreneur and a seasoned trader, I have come to understand that wealth encompasses much more than material success. In fact, wealth is deeply interconnected with the Four Pillars: Dharma (righteousness), Artha (wealth), Kama (desire), and Moksha (liberation). Each pillar supports the others, leading to a balanced, meaningful life.

Dharma emphasizes ethical ways of generating wealth. My early career involves stories of trading where integrity faced numerous tests. There were moments when faster gains presented themselves at the cost of ethical standards. Yet, holding on to principles of truth and fairness, aligning with Dharma, served better in the long run, attracting not just material success, but trust among peers and clients.

Arthaor the pursuit of wealth, should not be about hoarding but about the wise and right use of resources. In the words of Sai Baba, “Wealth should be used for the right purposes, not for self-indulgence.” This teaching remains a guiding light in my trading practices, where understanding the real value behind investment decisions is crucial.

Like represents desires, which need to be balanced with ethical considerations. Mindful spending brings joy and fulfillment when it is aligned with one’s deeper values, rather than transient pleasures. Reflecting on my trading experiences, I learned the hard way that gratification from hasty investments was short-lived, while thoughtful, aligned decisions cultivated lasting satisfaction.

Lastly, Moksha teaches us about detachment — the ultimate liberation from the material. Understanding the transient nature of money transforms how we interact with it. Financial discipline becomes not just a necessity but a spiritual practice. Sai Baba wisely reminded us, “Do not be obsessed by the consciousness of money. Be only conscious of your obligations.”

The T.E.A.R. Formula

To systematically integrate ethical financial management, I developed the T.E.A.R. formula: Truth, Ethics, Accountability, and Responsibility.

-

Truth in financial dealings means transparency and honesty. A lesson I learned early in my trading career was the importance of absolute honesty in financial reporting — even when it meant short-term losses. This trustworthiness has always paved the way for long-term integrity and success.

-

Ethics ensures that every financial decision respects both the self and others. Consider the choice of where our money goes — supporting ethical companies and causes, those practices create a ripple effect of positive change.

-

Accountability keeps us honest and committed to our financial goals. Maintaining logs, or as I call it, a “gratitude ledger,” helps in tracking not just expenses and earnings, but also the purpose behind each investment.

-

Responsibility emphasizes conscious investment. Like a seasoned trader who chooses stable prospects over risky ventures, each financial decision must be made with awareness of its broader impact.

Personal Stories of Discipline and Faith

Throughout my career, maintaining discipline in financial management required faith and perseverance. I recall a period during a market downturn when emotions ran high. Through dedicated time-blocking for analysis, balanced decision-making, and the discipline to detach from the outcome, I navigated the turmoil without losing sight of my ethical compass.

Actionable Habits for Ethical Financial Management

-

Time-Blocking: Dedicate specific time slots for financial planning and review. Use this time to realign goals with spiritual values, ensuring decisions are thoughtfully made.

-

Charity Budget: Allocate a portion of income to charitable causes regularly. This practice not only serves others but nurtures a sense of abundance and detachment within oneself.

-

Gratitude Ledger: Keep a record of financial inflows and outflows, paired with notes of gratitude for what each transaction enables. This transforms routine financial management into a practice of mindful appreciation.

-

Reflective Journaling: At the end of each month, reflect on financial decisions. Identify areas of improvement and celebrate alignments with ethical and spiritual values.

-

Periodic Digital Detox: Set aside time to disconnect from the digital world periodically. Use this time to meditate and reflect, deepening the understanding of true wealth.

Conclusion

In embracing ethical financial management as a spiritual practice, we engage in a transformative journey that enriches both our material and spiritual lives. Wealth is a means to fulfill life’s ultimate purpose — aligning ourselves with the Four Pillars and empowering other beings we share this planet with.

I invite you to explore these insights and practices further by visiting SaiSankalpam.com where we offer resources and community discussions on integrating spirituality into all facets of life.

Stay blessed, and may your financial journey be one of service and abundance.

Warm regards,

Dr. Ravindranath G

Founder, SaiSankalpam.com

🙏 Support SaiSankalpam

If this content has helped or inspired you, you may offer a voluntary contribution.

⚠️ Disclaimer:

This is a voluntary contribution. No goods or services are sold.

Payments are processed securely by your UPI app.

SaiSankalpam does not store or access your payment information.

Before you leave, offer Aarathi to Swamy and take His blessings

👁️ Viewed by 28,507 readers